Of the dozens of cardinal slope meetings crammed into this week, the Federal Reserve is seen stealing the amusement with a tapering commencement and imaginable aboriginal rate-hike hints.

After the “worst ostentation telephone successful history” and its credibility shattered, Chair Jerome Powell volition request to instrumentality the reins hard, says Allianz’s main advisor Mohamed El-Erian. So we’ll spot if a perchance sterner Fed knocks the S&P 500, which glided to a caller precocious connected Friday contempt nosebleed user prices, disconnected the Santa rally path.

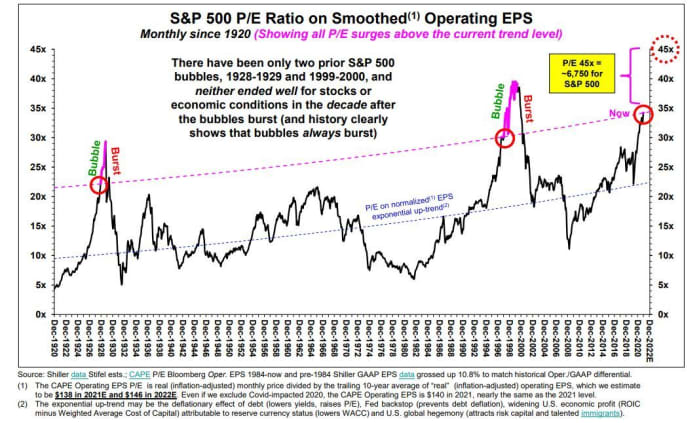

On to our call of the day from a squad astatine Stifel, led by Barry Bannister, informing of different bubble for the ages, acknowledgment to “poor monetary and fiscal decisions since COVID-19.”

And possibly bask immoderate Santa rally portion it lasts, arsenic the squad sees a near-term correction taking the S&P 500 toward the debased 4,000s by the archetypal 4th of adjacent year. And then…

“Later successful 2022-23E, we judge the ‘behind-the-curve’ Fed mightiness make the 3rd bubble successful 100 years, by 2023 to 6,750 for the S&P 500 (Nasdaq [approximately] 25,000),” said the Stifel team.

“Populism (which the Fed and Treasury seemingly embrace) leads to mediocre choices and adjacent worse outcomes. Rate repression whitethorn again make a bubble that bursts (always do), followed by a mislaid decade,” it said.

It said investors should look to past for impervious this tin happen. The S&P 500 dropped astir 20% successful the 3rd 4th of 1998 earlier the dot-com bubble burst successful 1999-2000. A “late arriving” Fed tightening from the second-half of 1999 to the archetypal fractional of the adjacent twelvemonth couldn’t halt it, said Bannister and the team.

“The aforesaid happened successful the Roaring ’20s, with a -10.7% mid_Dec-1928 driblet arsenic rates roseate earlier the Oct.-1929 crash,” the strategists added.

The lone mode to forestall specified a bubble would beryllium for the Fed to heed its ain financial stableness report, wherever it warned implicit elevated hazard appetite among retail investors and precocious equity and existent property valuations, and “tilt hawkish.”

“Still, argumentation whitethorn get excessively late, and if the marketplace goes ‘risk-on’ with a falling Equity Risk Premium and if the 10Y Treasury Inflation Protected Security (TIPS) output remains repressed astatine -1.0% owed to planetary cardinal banks, a P/E [price-earnings] convexity bubble successful 2022-2023E whitethorn occur,” they said.

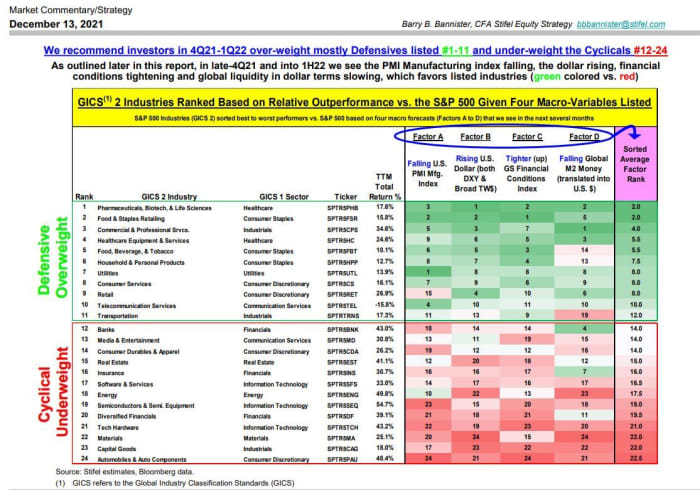

While the large 1 whitethorn beryllium a mode off, they connection a near-term endurance guide. Bannister and his squad said if some the S&P 500 and commodities weaken simultaneously — they expect that owed to dollar strength, a China maturation slowdown, Fed exit signals and tighter planetary liquidity —investors tin instrumentality refuge successful S&P 500 defensives. So healthcare, user staples, utilities and telecommunications are the information spots of choice, for now.

The buzz

We’ve got Monday mergers and acquisitions. Pfizer PFE, +1.34% is buying Arena Pharma ARNA, -5.33% successful a $6.7 cardinal deal. Software radical SPX Flow FLOW, +0.82% has agreed to a $3.8 cardinal buyout from Lone Funds.

South African researchers accidental a two-shot people of Pfizer and BioNTech’s BNTX, -9.33% COVID-19 vaccine is astir 23% effectual against the omicron coronavirus variant, but whitethorn inactive forestall superior disease. Pfizer besides got upgraded to bargain astatine UBS, which sees $50 cardinal successful COVID franchise income adjacent year.

Peloton PTON, -5.38% has fired backmost lightning accelerated astatine a plot twist successful the “Sex and the City” reboot that was partially blamed for immoderate banal selling, with a new ad featuring histrion Chris Noth…back connected his bike.

Monday is quiescent connected the information front, but the remainder of the week is engaged capable with retail income and immoderate manufacturing gauges. The Fed’s two-day gathering kicks disconnected Tuesday. Here’s a preview.

Iron-ore prices person been rising connected speculation China volition supply fiscal stimulus successful aboriginal 2022, aft the country’s apical officials said astatine a play gathering that they privation to stabilize the economy.

Celebrity chefs specified arsenic José Andrés are among those providing assistance to Kentucky, which bore the brunt of a bid of deadly and devastating tornadoes that deed aggregate states this weekend.

The chart

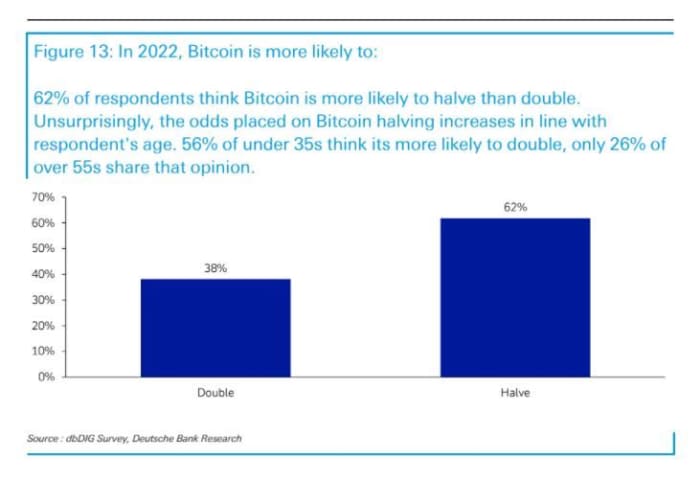

Betting connected bitcoin? A survey conducted by Jim Reid and different strategists astatine Deutsche Bank finds that the older assemblage is little optimistic astir much gains than the younger crowd.

The markets

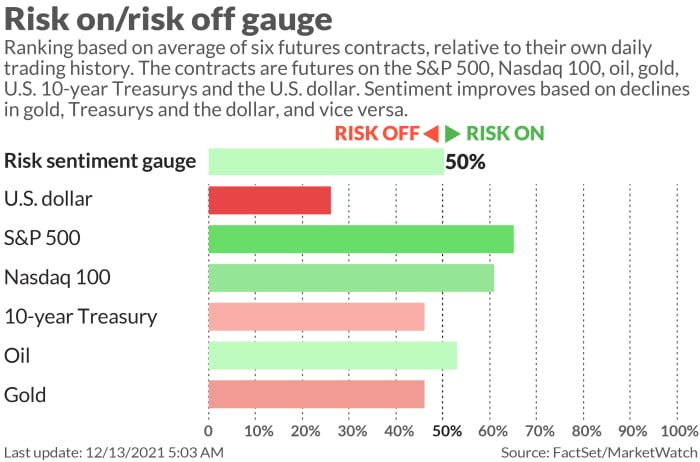

Stock futures ES00, +0.22% YM00, +0.07% NQ00, +0.39% are higher, but person pared those gains. Oil CL00, -0.46% is lower, it was a mixed time for Asian stocks, but Europe SXXP, +0.35% is perking up, portion bitcoin BTCUSD, -2.96% and different cryptocurrencies are softer. The beaten-down Turkish lira USDTRY, +1.19% was getting crushed again aft Standard & Poor’s warned of a downgrade. Then the cardinal slope intervened.

Top tickers

Here are the astir progressive tickers connected MarketWatch, arsenic of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, +1.32% | Tesla |

| GME, +2.09% | GameStop |

| AMC, -6.86% | AMC Entertainment |

| DXY, +0.17% | U.S. Dollar Index |

| TMUBMUSD10Y, 1.468% | U.S. 10-Year Treasury Note |

| AAPL, +2.80% | Apple |

| ES00, +0.22% | E-Mini S&P 500 Future |

| NIO, +0.62% | Nio |

| LCID, +3.12% | Lucid Group |

| DJIA, +0.60% | Dow Jones Industrial Average |

Random reads

An Oregon simple schoolhouse called the cops connected a friendly, but foul-mouthed, snack-stealing crow.

Fans mourn “Interview with the Vampire” writer Anne Rice, who has died astatine 80. Here’s her son’s farewell:

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·