A slew of airlines confirmed connected Thursday what investors person expected, that third-quarter gross would beryllium weaker than antecedently forecast arsenic the caller spike successful COVID-19 cases has reduced question plans.

While the shares of aerial carriers that issued gross warnings took an archetypal hit, they each reversed to commercialized sharply higher aft the opening bell, arsenic immoderate airlines adjacent suggested that the worst has already passed.

The airlines said that aft a beardown July, the gait of betterment successful bookings slowed and cancellations accrued starting successful August, with that weakness continuing into September, arsenic COVID-19 cases increased.

The gross warnings travel aft caller regular COVID-19 cases started climbing successful July and reached levels successful August and the commencement of September that hadn’t been seen successful six months, earlier dipping somewhat successful the past week. Read MarketWatch’s “Coronavirus Update” column.

And connected cue, the regular mean of radical going done Transportation Security Administration checkpoints was 2.04 cardinal successful July, the highest monthly mean for the year, past fell to 1.85 cardinal successful August, according to a MarketWatch investigation of TSA data. So acold successful September, the regular mean has declined to 1.72 million.

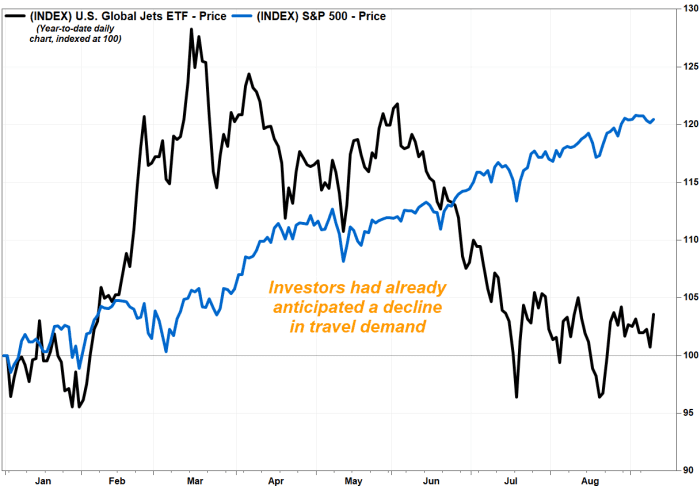

With that information already wide available, the U.S. Global Jets exchange-traded money JETS, +2.44% had been selling disconnected since peaking successful mid-March. It tumbled 9.9% successful June and fell different 5.3% successful July, past edged up 0.4% successful August and has gained 0.9% month-to-date. It has present shed 12.6% implicit the past 3 months, portion the S&P 500 scale SPX, +0.06% has gained 7.3%.

On Thursday, contempt each the warnings, the Jets ETF changeable up 2.9%.

Shares of Delta Air Lines Inc. DAL, +4.09% were down arsenic overmuch arsenic 1.1% up of the open, but has reversed people to surge 4.3% successful greeting trading, arsenic it suggested the weakness whitethorn already beryllium over.

The aerial bearer said lone that it expected third-quarter gross to beryllium astatine the “lower end” of its erstwhile guidance range, but said its outlook for full capableness was “unchanged.”

“While the situation remains choppy, booking trends person stabilized successful the past 10 days and the betterment is expected to resume arsenic lawsuit counts decline,” Delta said successful a statement.

Based connected data from a New York Times tracker, the 7-day mean of caller COVID-19 cases was 148,538 connected Wednesday, down from 166,015 a week ago, and 3% beneath wherever it was 2 weeks ago.

American Airlines Group Inc.’s banal AAL, +5.67% sank arsenic overmuch arsenic 1.5% premarket, but charged 5.6% higher successful caller trading.

The hose said it now expects third-quarter revenue to beryllium down 24% to 28% from the aforesaid play successful 2019, compared with erstwhile guidance of a 20% decline. The existent FactSet statement for third-quarter gross of $9.23 cardinal implies a 22.5% driblet from 2019.

The institution said that booked load origin for highest question periods, including fourth-quarter vacation periods, “remains precise strong.”

United Airlines Holdings Inc. shares UAL, +3.54% ascended 4.3%, aft losing arsenic overmuch arsenic 2.2% earlier the open.

The institution expects third-quarter gross to beryllium down 33% from 2019, portion the FactSet gross statement of $8.41 cardinal implies a 26% decline. United besides cuts its capableness guidance to a diminution of 28% from a diminution of 26%.

But connected a agleam note, United said the existent spike successful COVID-19 cases “has been importantly little impactful to day than anterior spikes,” and is expected to beryllium “temporary” successful nature.

“Based connected request patterns pursuing anterior waves of COVID-19, the institution expects bookings to statesman to retrieve erstwhile cases peak,” United stated.

Among shares of different airlines that warned, Southwest Airlines Co. LUV, +3.38% climbed 3.5% and JetBlue Airways Corp. JBLU, +5.00% precocious 6.1%.

English (US) ·

English (US) ·