Shares of Costco Wholesale Corp. are apt to dip aft the membership-based warehouse retail elephantine reports earnings, but that’s erstwhile investors should buy, said long-time bullish expert Rupesh Parikh astatine Oppenheimer.

Parikh said aft helium spent clip reviewing Costco’s prospects heading into the net release, helium believes determination is “limited net upside.” He said helium besides believes that aft the stock’s caller outperformance, the “robust and accelerating [same-store sales] trends” reported successful caller months are already priced into the shares.

“As a result, we spot the setup connected the people arsenic little attractive,” Parikh wrote successful a probe note.

The banal COST, -0.99% slumped 1.2% successful day trading. It has pulled backmost 1.8% since it closed astatine a grounds $465.94 connected Sept. 9.

Coscto is scheduled to study fiscal fourth-quarter results connected Sept. 23, aft the closing bell. The FactSet statement is for net per stock to emergence to $3.57 from $3.51 a twelvemonth ago, for income to turn 15.0% to $61.4 cardinal and for same-store income to summation 12.4%.

Earlier this month, Costco said income for the 4 weeks ended Aug. 29 roseate 16.2% from a twelvemonth agone to $13.56 billion, portion full same-store income grew 14.2%, including 14.7% maturation successful the U.S.

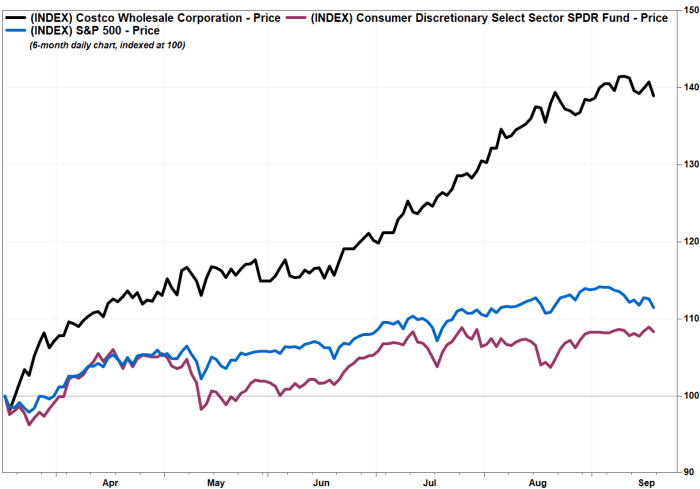

The banal has tally up 39.0% implicit the past six months, portion the SPDR Consumer Staples Select Sector exchange-traded money XLP, -0.35% has gained 7.8% and the S&P 500 scale SPX, -0.90% has precocious 11.5%.

One of the reasons for Parikh’s caution up of net is that the banal has historically not performed good pursuing the results.

Costco’s banal has mislaid crushed connected the time aft six of the past 7 quarterly reports, and aft 11 of the past 14 reports, according to FactSet data. That’s adjacent aft Costco bushed EPS and same-store income expectations successful 10 of the past 14 quarters and income expectations successful 12 of the past 14 quarters.

But if the banal falls again, Parikh said that’s erstwhile investors should leap in.

“We would instrumentality vantage of immoderate imaginable nett taking successful what we presumption arsenic a high-expectation setup pursuing the rally,” Parikh wrote. “As we look forward, we expect sticky marketplace stock gains, ostentation benefits, prospects for different peculiar dividend and a imaginable rank interest summation adjacent twelvemonth to assistance substance the adjacent limb higher for shares.”

He reiterated the outperform standing he’s had connected the banal for astatine slightest the past 3 years. He kept his terms people astatine $500, which is astir 9.2% supra existent levels.

English (US) ·

English (US) ·