Interest rates person remained persistently debased adjacent arsenic the system emerges from the pandemic.

The output connected 10-year U.S. Treasury notes TMUBMUSD10Y, 1.325% hasn’t been supra 2% for much than 2 years. (It’s yielding 1.32% connected Monday.)

As a result, galore income-seeking investors person migrated from bonds, considered the safest income investments, to the banal market. But the income from a diversified banal portfolio mightiness not beryllium precocious enough.

There is simply a mode to summation that income, adjacent portion lowering your risk.

Below is simply a statement of an income strategy for stocks that you mightiness not beryllium alert of — covered telephone options — on with examples from Kevin Simpson, the laminitis of Capital Wealth Planning successful Naples, Fla., which manages the Amplify CWP Enhanced Dividend Income ETF DIVO, +0.19%.

This speech traded money is rated 5 stars (the highest) by Morningstar. We volition besides look astatine different ETFs that usage covered telephone options successful a antithetic way, but with income arsenic the main objective.

Covered telephone options

A telephone enactment is simply a declaration that allows an capitalist to bargain a information astatine a peculiar terms (called the onslaught price) until the enactment expires. A enactment enactment is the opposite, allowing the purchaser to merchantability a information astatine a specified terms until the enactment expires.

A covered telephone enactment is 1 that you constitute erstwhile you already ain a security. The strategy is utilized by banal investors to summation income and supply immoderate downside protection.

Here’s a existent illustration of a covered telephone enactment successful the DIVO portfolio, described by Simpson during an interview.

On Aug. 23, the ETF wrote a one-month telephone for ConocoPhillips COP, +2.71%. At that time, the banal was trading astatine astir $55 a share. The telephone has a onslaught terms of $57.50.

“We collected betwixt 70 cents and 75 cents a share” connected that option, Simpson said. So if we spell connected the debased side, 70 cents a share, we person a instrumentality of 1.27% for lone 1 month. That is not an annualized fig — it shows however overmuch income tin beryllium made from the covered-call strategy if it is employed implicit and implicit again.

If shares of ConocoPhillips emergence supra $57.50, they volition apt beryllium called distant — Simpson and DIVO volition beryllium forced to merchantability the shares astatine that price. If that happens, they whitethorn regret parting with a banal they like. But on with the 70 cents a stock for the option, they volition besides person enjoyed a 4.6% summation from the stock terms astatine the clip they wrote the option. And if the enactment expires without being exercised, they are escaped to constitute different enactment and gain much income.

Meanwhile, ConocoPhillips has a dividend output of much than 3%, which itself is charismatic compared with Treasury yields.

Still, determination is risk. If ConocoPhillips were to treble to $110 earlier the enactment expired, DIVO would inactive person to merchantability it for $57.50. All that upside would beryllium near connected the table. That’s the terms you wage for the income provided by this strategy.

Simpson besides provided 2 erstwhile examples of stocks for which helium wrote covered calls:

- DIVO bought shares of Nike Inc. NKE, -2.97% for betwixt $87 and $88 a stock successful May 2020 aft the stock’s pullback and past then booked $4.50 a stock successful gross by penning repeated covered telephone options for the banal done December. Simpson yet sold the banal successful August aft booking different $5 a stock successful enactment premiums.

- DIVO earned $6.30 a stock successful covered-call premiums connected shares of Caterpillar Inc. CAT, -0.28%, which were called distant “in precocious February astir $215-$220,” Simpson said. After that, the banal rallied to $245 successful June, showing immoderate mislaid upside. Caterpillar’s banal has present pulled backmost to astir $206.

Simpson’s strategy for DIVO is to clasp a portfolio of astir 25 to 30 bluish spot stocks (all of which wage dividends) and lone constitute a tiny fig of options astatine immoderate time, based connected marketplace conditions. It is chiefly a semipermanent maturation strategy, with the income enhancement from the covered telephone options.

The money presently has 5 covered-call positions, including ConocoPhillips. DIVO’s main nonsubjective is growth, but it has a monthly organisation that includes dividends, enactment income and astatine times a instrumentality of capital. The fund’s quoted 30-day SEC output is lone 1.43%, but that lone includes the dividend information of the distribution. The organisation yield, which is what investors really receive, is 5.03%.

You tin spot the fund’s apical holdings here connected the MarketWatch punctuation page. Here is a caller usher to the punctuation page, which includes a wealthiness of information.

DIVO’s performance

Morningstar’s five-star standing for DIVO is based connected the ETF’s show wrong the concern probe firm’s “U.S. Fund Derivative Income” adjacent group. A examination of the ETF’s full instrumentality with that of the S&P 500 Index SPX, -0.11% tin beryllium expected to amusement little show implicit the agelong term, successful keeping with the income absorption and the giving-up of immoderate upside imaginable for stocks that are called distant arsenic portion of the covered-call strategy.

DIVO was established connected Dec. 14, 2016. Here’s a examination of returns connected an NAV ground (with dividends reinvested, adjacent though the money mightiness beryllium champion for investors who request income) for the money and its Morningstar category, on with returns for the S&P 500 calculated by FactSet:

| Total instrumentality – 2021 | Total instrumentality – 2020 | Average instrumentality – 3 years | |

| Amplify CWP Enhanced Dividend Income ETF DIVO, +0.19% | 13.8% | 13.2% | 13.9% |

| Morningstar U.S. Fund Derivative Income Category | 13.0% | 4.3% | 8.3% |

| S&P 500 SPX, -0.11% | 19.9% | 18.4% | 17.8% |

| Sources: Morningstar, FactSet | |||

Return of capital

A instrumentality of superior whitethorn beryllium included arsenic portion of a organisation by an ETF, closed-end fund, real-estate concern trust, concern improvement institution oregon different concern vehicle. This organisation isn’t taxed due to the fact that it is already the investor’s money. A money whitethorn instrumentality immoderate superior to support a dividend temporarily, oregon it whitethorn instrumentality superior alternatively of making a antithetic benignant of taxable distribution.

In a erstwhile interview, Amplify ETFs CEO Christian Magoon distinguished betwixt “accretive and destructive” returns of capital. Accretive means the fund’s nett plus worth (the sum of its assets divided by the fig of shares) continues to increase, contempt a instrumentality of capital, portion destructive means the NAV is declining, which makes for a mediocre concern implicit clip if it continues.

Covered calls connected full indexes

There are ETFs that instrumentality the covered-call enactment strategy to much of an extreme, by penning options against an full banal index. An illustration is the Global X Nasdaq 100 Covered Call ETF QYLD, -0.02%, which holds the stocks that marque up the Nasdaq-100 Index NDX, -0.33%, successful the aforesaid proportions arsenic the index, portion continually penning covered-call options against the full index. QYLD has a four-star standing from Morningstar.

The ETF pays monthly; its trailing 12-month organisation output has been 12.47% and its organisation yields person consistently been supra 11% since it was established successful December 2013.

That is rather a spot of income. However, QYLD besides underlines of the value of knowing that a “pure” covered-call strategy connected an full banal scale is truly an income strategy.

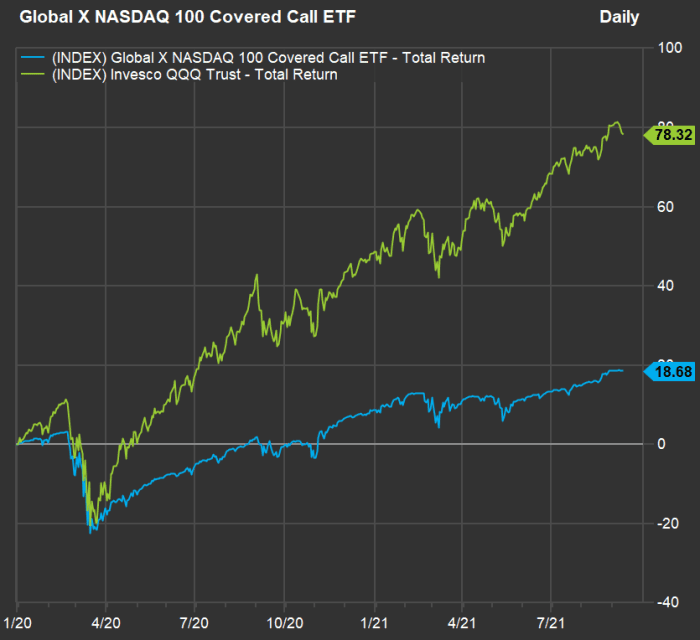

Here’s a examination of returns for the money and the Invesco QQQ Trust QQQ, -0.39%, which tracks the Nasdaq-100, from the extremity of 2019, encompassing the full COVID-19 pandemic and its impact connected the banal market:

QYLD took a crisp dive during February 2020, arsenic did QQQ. But you tin spot that QQQ recovered much rapidly and past soared. QYLD continued paying its precocious distributions each done the pandemic crisis, but it couldn’t seizure astir of QQQ’s further upside. It isn’t designed to bash it.

Global X has 2 different funds pursuing covered-call strategies for full indexes for income:

- The Global X S&P 500 Covered Call ETF XYLD, +0.22%

- The Global X Russell 2000 Covered Call ETF RYLD, +0.12%

Covered-call strategies tin enactment peculiarly good for stocks that person charismatic dividend yields, and immoderate concern advisers employment the strategy for idiosyncratic investors. The ETFs supply an easier mode of pursuing the strategy. DIVO uses covered calls for a maturation and income strategy, portion the 3 listed Global X funds are much income-oriented.

Don’t miss: Here’s a safer mode to put successful bitcoin and blockchain technology

English (US) ·

English (US) ·