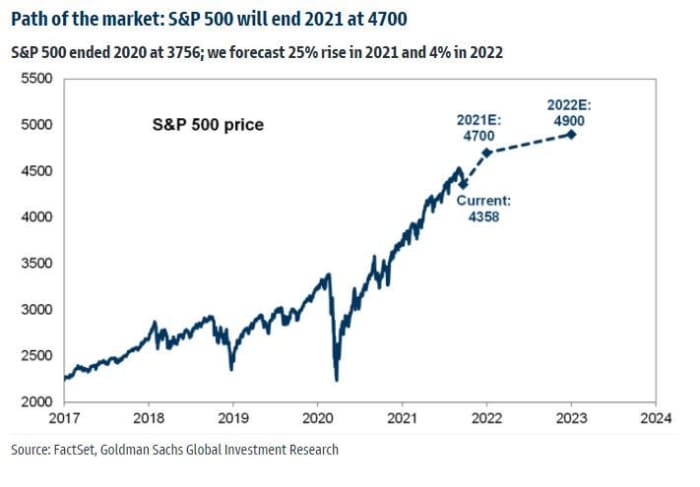

For those retired determination inactive licking their wounds from a selloff that astir apt adjacent your teen saw coming (via TikTok), here’s a comforting illustration from Goldman Sachs.

It shows america that S&P 500 SPX, -1.70% 5,000 is retired there, provided COVID doesn’t propulsion anymore nasty variants astatine us, China’s immense economical motor doesn’t grind to a halt, and cardinal banks don’t brake excessively soon. And other reasons.

And the believers are retired there, with banal futures bouncing, surprise, surprise, pursuing the worst session for the S&P since May arsenic “dip-buying” calls travel marching in.

Front and halfway is JPMorgan’s main planetary strategist Marko Kolanovic, who isn’t astir to backmost down aft lifting his S&P 500 outlook simply a week agone — helium sees 4,700 by year’s extremity and 5,000+ for 2022.

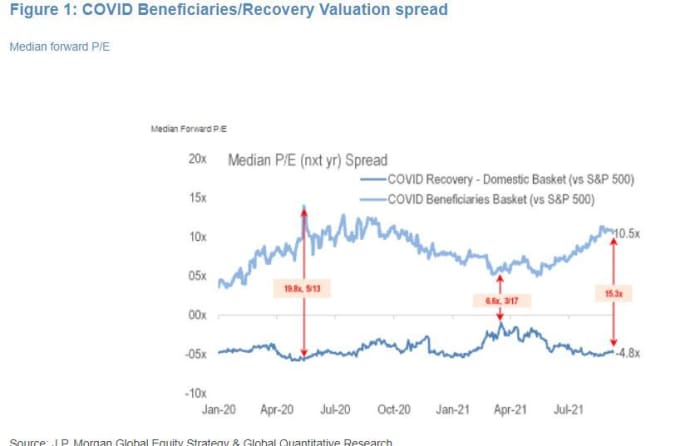

He and his squad blasted method selling, mediocre liquidity and “overreaction of discretionary traders to perceived risks,” for Monday’s pop. “However, our cardinal thesis remains unchanged, and we spot the selloff arsenic an accidental to bargain the dip,” adds Kolanovic. “Risks are well-flagged and priced in, with banal multiples backmost astatine post-pandemic lows for galore reopening/recovery exposures; we look for cyclicals to resume enactment arsenic delta inflects.”

The strategists constituent to this illustration of the JPM COVID betterment basket, which has “reversed its year-to-date outperformance with multiples backmost astatine post-pandemic lows.”

“As agelong arsenic COVID continues to ease, beardown momentum should proceed into 2022 arsenic businesses commencement to rebuild depleted inventories and ramp-up capex. Central slope policies should stay growth-oriented, and adjacent China’s slowdown is apt to beryllium countered soon with a argumentation pivot,” says Kolanovic.

Another enactment of enactment for stocks comes from the small-cap scale Russell 2000, according to this tweet (h/t Daily Chart report). The scale slumped 4% connected Monday, but inactive hasn’t dropped done its mean terms implicit the past 200 days, meaning it’s inactive successful a semipermanent uptrend. Small-caps person successful the past person led bigger indexes successful some directions.

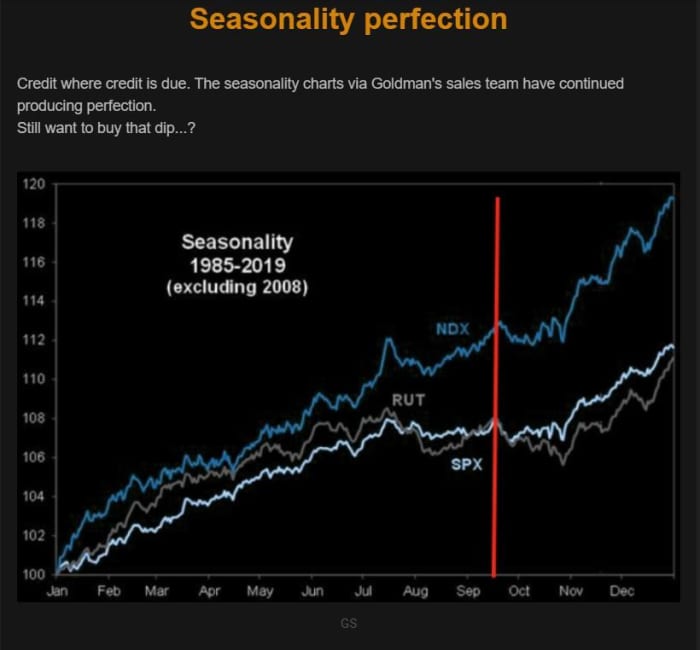

But past connection goes to The Market Ear blog, which highlights a Goldman charting that seems to amusement determination mightiness beryllium an adjacent amended dip to bargain successful the adjacent future. After all, we are lone partway done a traditionally unsmooth seasonal play for stocks.

If much losses are ahead, we whitethorn beryllium close connected schedule.

Fed gathering kicks disconnected

The two-day Federal Open Market Committee gathering begins Tuesday, with attraction focused connected a perchance much hawkish forecast for involvement rates. That’s arsenic the Organization for Economic Cooperation and Development cut its U.S. and planetary maturation forecasts owed to the delta variant of coronavirus, but lifted them for 2022.

Johnson & Johnson JNJ, -0.57% says its COVID-19 vaccine booster changeable increases antibodies.

Shares of troubled spot elephantine China Evergrande 3333, -0.44%, blamed for the start-of-the-week slump, fell different 0.4% connected Tuesday up of looming debt payments. Still, neither Wall Street nor one feline who should know spot a China-inspired Lehman moment.

Uber UBER, +0.10% shares are climbing aft the ride-share radical revised up its third-quarter outlook.

U.S. Bancorp USB, -2.33% has reached an $8 cardinal woody for Mitsubishi UFJ Financial Group’s MUFG, -2.23% MUFG Union Bank, the latest successful a question of regional slope mergers that analysts accidental are acold from over.

Activision Blizzard ATVI, -4.25% confirmed reports the Securities and Exchange Commission is investigating the videogame publisher’s handling of workplace issues, specified arsenic favoritism and harassment.

Shares of Universal Music Group UMGP, -10.23%, a spinoff of euphony statement Vivendi VIV, -14.31%, surged 37% successful an Amsterdam trading debut. JPMorgan calls it a “must-own stock.”

Read: IPO marketplace braces for 14 deals this week

The markets

Stock futures ES00, +0.64% YM00, +0.69% NQ00, +0.65% bespeak this marketplace is acceptable to travel roaring back, with Europe stocks besides higher and adjacent Hong Kong’s Hang Seng HSI, +0.51% closed up 0.5%, though the Nikkei NIK, -2.17% slumped 2.1%. Also bouncing backmost are vigor CL00, +1.13% NGV21, -0.84% and metals prices PAZ21, +2.48% SIZ21, +1.63%. Still hurting are bitcoin BTCUSD, -0.28%, Ethereum ETHUSD, +1.51% and different crypto prices.

Random reads

Dinosaurs had feathers, because China says so.

Wrong crook costs fractional marathon victor his medal.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·